ARC Resources Ltd. Reports Strong Second Quarter Results

Jul 29, 2015

CALGARY, July 29, 2015 /CNW/ - (ARX - TSX) ARC Resources Ltd. ("ARC") is pleased to report its second quarter 2015 operating and financial results. Second quarter production averaged 109,900 boe per day and funds from operations were $206.3 million ($0.61 per share). ARC's unaudited Condensed Interim Consolidated Financial Statements and Notes, as well as ARC's Management's Discussion and Analysis ("MD&A") for the three and six months ended June 30, 2015 and 2014, are available on ARC's website at www.arcresources.com and on SEDAR at www.sedar.com.

|

Three Months Ended June 30 |

Six Months Ended June 30 |

|||||||||

|

2015 |

2014 |

2015 |

2014 |

|||||||

|

FINANCIAL |

||||||||||

|

(Cdn$ millions, except per share and boe amounts) |

||||||||||

|

Funds from operations (1) |

206.3 |

295.8 |

397.8 |

588.1 |

||||||

|

Per share (2) |

0.61 |

0.93 |

1.18 |

1.86 |

||||||

|

Net income (loss) |

(51.0) |

147.4 |

(52.7) |

176.8 |

||||||

|

Per share (2) |

(0.15) |

0.47 |

(0.16) |

0.56 |

||||||

|

Dividends |

102.1 |

94.8 |

203.7 |

189.3 |

||||||

|

Per share (2) |

0.30 |

0.30 |

0.60 |

0.60 |

||||||

|

Capital expenditures, before land and net property acquisitions (dispositions) |

98.4 |

236.1 |

227.9 |

478.1 |

||||||

|

Total capital expenditures, including land and net property acquisitions (dispositions) |

97.7 |

226.4 |

217.6 |

504.9 |

||||||

|

Net debt outstanding (3) |

878.1 |

1,061.9 |

878.1 |

1,061.9 |

||||||

|

Shares outstanding, weighted average diluted |

340.7 |

316.6 |

337.1 |

315.9 |

||||||

|

Shares outstanding, end of period |

341.5 |

316.5 |

341.5 |

316.5 |

||||||

|

OPERATING |

||||||||||

|

Production |

||||||||||

|

Crude oil (bbl/d) |

31,958 |

35,317 |

33,894 |

36,391 |

||||||

|

Condensate (bbl/d) |

3,139 |

4,462 |

3,363 |

3,679 |

||||||

|

Natural gas (MMcf/d) |

426.0 |

397.2 |

442.7 |

383.5 |

||||||

|

NGLs (bbl/d) |

3,795 |

4,179 |

4,053 |

3,962 |

||||||

|

Total (boe/d) (4) |

109,900 |

110,165 |

115,098 |

107,944 |

||||||

|

Average realized prices, prior to hedging |

||||||||||

|

Crude oil ($/bbl) |

64.49 |

102.14 |

56.20 |

98.78 |

||||||

|

Condensate ($/bbl) |

64.84 |

103.72 |

56.49 |

102.31 |

||||||

|

Natural gas ($/Mcf) |

2.88 |

4.99 |

2.97 |

5.28 |

||||||

|

NGLs ($/bbl) |

9.53 |

39.51 |

12.99 |

43.76 |

||||||

|

Oil equivalent ($/boe) (4) |

32.10 |

56.44 |

30.07 |

57.16 |

||||||

|

Operating Netback ($/boe) |

||||||||||

|

Commodity and other sales |

32.17 |

56.56 |

30.16 |

57.24 |

||||||

|

Royalties |

(2.50) |

(8.02) |

(2.66) |

(8.21) |

||||||

|

Transportation expenses |

(2.33) |

(2.02) |

(2.35) |

(1.97) |

||||||

|

Operating expenses |

(8.05) |

(9.11) |

(7.63) |

(9.04) |

||||||

|

Netback before hedging |

19.29 |

37.41 |

17.52 |

38.02 |

||||||

|

Realized hedging gain (loss) (5) |

5.08 |

(2.53) |

4.58 |

(2.34) |

||||||

|

Netback after hedging |

24.37 |

34.88 |

22.10 |

35.68 |

||||||

|

TRADING STATISTICS (6) |

||||||||||

|

High price |

25.60 |

33.68 |

25.87 |

33.68 |

||||||

|

Low price |

21.01 |

30.30 |

20.75 |

27.52 |

||||||

|

Close price |

21.40 |

32.49 |

21.40 |

32.49 |

||||||

|

Average daily volume (thousands) |

1,424 |

1,037 |

1,682 |

1,142 |

||||||

|

(1) |

Funds from operations does not have a standardized meaning under Canadian Generally Accepted Accounting Principles ("GAAP"). See "Additional GAAP Measures" in the MD&A for the three and six months ended June 30, 2015 and 2014. |

|

(2) |

Per share amounts (with the exception of dividends) are based on weighted average diluted shares. |

|

(3) |

Net debt does not have a standardized meaning under GAAP. See "Additional GAAP Measures" in the MD&A for the three and six months ended June 30, 2015 and 2014. |

|

(4) |

In accordance with National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities ("NI 51-101"), a boe conversion ratio of 6 Mcf : 1 bbl has been used, which is based on an energy equivalency conversion method primarily applicable at the burner tip. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency of the conversion ratio, utilizing the 6:1 conversion ratio may be misleading as an indication of value. |

|

(5) |

Includes realized cash gains and losses on risk management contracts. |

|

(6) |

Trading prices are stated in Canadian dollars and based on intra-day trading. |

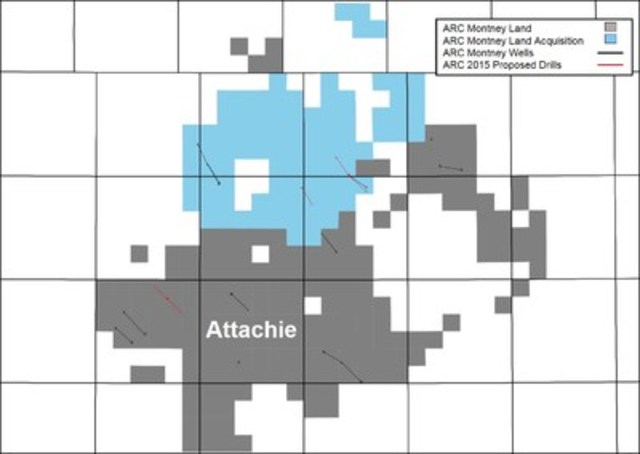

"ARC's team executed another strong quarter with a continued focus on capital efficiency gains and cost reductions across our business," stated Myron Stadnyk, President and CEO. "Development of our world-class Montney assets progressed with investment on key expansion projects at Sunrise and Tower. Additionally, we bolstered our Montney land position with the acquisition of new lands at the highly prospective Attachie property in northeast British Columbia; bringing ARC's total Montney land position to over 1,100 net sections. ARC's balance sheet remains strong, giving us the financial flexibility to proceed with our long-term development plans and to continue to deliver shareholder value through all commodity price cycles."

FINANCIAL AND OPERATING HIGHLIGHTS

- ARC achieved strong second quarter 2015 production of 109,900 boe per day, which was within the second quarter guidance range of 107,000 to 110,000 boe per day. Second quarter 2015 natural gas production of 426 MMcf per day was up seven per cent and crude oil and liquids production of 38,892 barrels per day was down 12 per cent compared to the second quarter of 2014. First half 2015 production of 115,098 boe per day was seven per cent higher than the first half of 2014, with natural gas production increasing 15 per cent to 443 MMcf per day as a result of new wells coming on-stream at Sunrise, and crude oil and liquids production decreasing six per cent to 41,310 barrels per day due to lower capital activity in response to declining crude oil prices.

- Construction of the new 60 MMcf per day Sunrise gas processing facility continued ahead of schedule and under budget. TransCanada Pipelines ("TCPL") began construction of its sales meter station during the second quarter, which is slated to be completed in mid-August. Commissioning of the plant is expected to begin prior to the end of August 2015, however, actual timing will depend on the completion and tie-in of the sales meter station.

- Second quarter and first half 2015 commodity sales revenue of $321.7 million and $628.3 million were down 43 per cent and 44 per cent, respectively, relative to comparable periods in 2014. Higher first half production was offset by significantly lower crude oil and natural gas prices in 2015. Crude oil and natural gas prices were down 36 per cent (Edmonton Par) and 43 per cent (AECO), respectively, relative to the second quarter of 2014, and down 42 per cent (Edmonton Par) and 40 per cent (AECO), respectively, relative to the first half of 2014.

- Second quarter funds from operations were $206.3 million ($0.61 per share), up eight per cent from the first quarter of 2015 as a result of higher realized quarter-over-quarter crude oil and natural gas prices. Second quarter funds from operations were down 30 per cent relative to the second quarter of 2014, and first half 2015 funds from operations of $397.8 million ($1.18 per share) were down 32 per cent relative to the first half of 2014. Higher production in the first half of 2015 was more than offset by significantly lower crude oil and natural gas prices relative to 2014. The decline in first half 2015 crude oil and natural gas prices was partially offset by realized gains on crude oil and natural gas hedging contracts of $98.7 million. ARC's cash flow is well-protected for the remainder of 2015 with 215,000 MMcf per day of natural gas hedged with average floor prices of US$3.94 per MMbtu and 15,000 barrels per day of oil hedged with collars and swaps. See the Risk Management section for more details.

- Second quarter and first half 2015 capital expenditures, before land and net property acquisitions and dispositions, totalled $98.4 million and $227.9 million, respectively, and were focused primarily on ARC's Montney lands in northeast British Columbia. ARC drilled 12 gross operated wells in the second quarter of 2015 (five oil wells and seven natural gas wells) and 37 gross operated wells in the first half of 2015 (22 oil wells, 13 natural gas wells, and two liquids-rich natural gas wells). ARC's first half 2015 activity levels were significantly lower than 2014 levels as certain capital projects were deferred to future periods in response to the decline in commodity prices.

- ARC grew its Montney landholdings in the second quarter of 2015 with the addition of 89 net sections in the highly prospective Montney oil and liquids-rich natural gas Attachie area; increasing its total Attachie land position to 279 net Montney sections. ARC has been piloting production in the area since 2011, and is further encouraged by industry well results offsetting the newly acquired lands. ARC has plans to drill three wells on the newly acquired lands in the second half of 2015, and two additional wells on existing lands in the winter of 2015/2016, with completions and evaluation of results expected to take place in 2016.

- During the second quarter of 2015, ARC divested certain non-core shallow gas assets located in southern Alberta with associated production of approximately 2,400 boe per day (98 per cent natural gas) and 12 MMboe of proved plus probable natural gas reserves. The divested properties, which are characterized with a higher relative cost profile compared to ARC's natural gas properties in the Montney region, comprised approximately 2,200 gross shallow gas wells (1,600 net wells), significantly reducing ARC's well count and associated abandonment liability.

- ARC's core principle of operational excellence was demonstrated in the first half of 2015 through several on-going initiatives, which resulted in lower operating costs and improved capital and operating efficiencies. With the decrease in commodity prices, ARC is focused on cost management by pursuing opportunities to reduce capital and operating expenses and defer certain discretionary spending where appropriate. ARC's second quarter and first half 2015 operating costs of $8.05 per boe and $7.63 per boe were 12 per cent and 16 per cent lower than comparable periods in 2014, respectively, and were attributed to certain realized cost savings and the addition of new production at lower relative costs to operate.

- ARC closed the quarter with a strong balance sheet including $878.1 million of net debt outstanding. At June 30, 2015, ARC had available credit and cash of approximately $1.35 billion taking into account ARC's working capital surplus. Net debt to 2015 annualized funds from operations ratio was 1.1 times and net debt was approximately 11 per cent of ARC's total capitalization at the end of the second quarter; both metrics are well within ARC's target levels.

- In response to the deterioration in commodity prices, on April 29, 2015, ARC announced a decrease to its 2015 planned capital program to $550 million (see news release entitled "ARC Resources Ltd. Reports Record First Quarter Production"). The reduced budget enables ARC to preserve its strong financial position while remaining focused on the long-term and advancing key strategic projects. The 2015 capital program is focused primarily on profitable development in the British Columbia Montney region, as projects in this area provide the highest rates of return and meet our investment hurdle rates at current commodity prices. ARC continues to see significant long-term value throughout its asset base and will resume development activities in other areas as reduced service costs are secured and economic conditions improve. ARC's full-year average production is expected to be in the range of 113,000 to 116,000 boe per day, which takes into account reduced 2015 capital spending and the divestment of 2,400 boe per day of non-core shallow gas production early in the second quarter of 2015. As a result of significantly reduced drilling and completions activities in the first half of 2015 and scheduled maintenance activities during the third quarter, ARC expects third quarter production to decline to 104,000 to 107,000 boe per day. Based on the planned start-up of the new Sunrise gas plant and expanded Tower oil battery, production is expected to increase to 122,000 to 126,000 boe per day in the fourth quarter. Assuming a 2016 capital program of approximately $600 million, ARC expects that full-year 2016 production should be in the range of 122,000 to 126,000 boe per day. ARC is well-positioned to fund the planned 2015 capital program, expected 2016 capital activities, and the Phase III Dawson Gas Plant development in 2017, given its strong balance sheet and proceeds received from the issuance of equity earlier in the year.

ECONOMIC ENVIRONMENT

ARC's 2015 financial and operational results were impacted by commodity prices and foreign exchange rates which are outlined in the following table.

|

Selected Benchmark Prices and Exchange Rates (1) |

Three Months Ended |

Six Months Ended |

||||||||||

|

June 30 |

June 30 |

|||||||||||

|

2015 |

2014 |

% Change |

2015 |

2014 |

% Change |

|||||||

|

Brent (US$/bbl) |

63.50 |

109.76 |

(42) |

59.35 |

108.82 |

(45) |

||||||

|

WTI oil (US$/bbl) |

57.95 |

102.99 |

(44) |

53.34 |

100.84 |

(47) |

||||||

|

Edmonton Par (Cdn$/bbl) |

67.73 |

105.62 |

(36) |

59.83 |

102.64 |

(42) |

||||||

|

Henry Hub NYMEX (US$/MMbtu) (2) |

2.64 |

4.60 |

(43) |

2.81 |

4.80 |

(41) |

||||||

|

AECO natural gas (Cdn$/Mcf) |

2.67 |

4.65 |

(43) |

2.81 |

4.72 |

(40) |

||||||

|

Cdn$/US$ exchange rate |

1.23 |

1.09 |

13 |

1.24 |

1.10 |

13 |

||||||

|

(1) |

The benchmark prices do not reflect ARC's realized sales prices. For average realized sales prices, refer to Table 13 in the MD&A for the three and six months ended June 30, 2015 and 2014. Prices and exchange rates presented above represent averages for the respective periods. |

|

(2) |

NYMEX Henry Hub "Last Day" Settlement. |

During the second quarter of 2015, global crude oil prices appreciated compared to the first quarter of the year. The quarter-over-quarter strengthening of North American crude oil prices was driven by seasonal storage draw downs, alleviating concerns of record inventory levels, and high US throughput on the back of strong refining margins. However, as a result of continued oversupply in global crude oil markets as well as global economic uncertainty, crude oil prices remained significantly lower relative to prices throughout 2014. The second quarter of 2015 WTI crude oil price averaged US$57.95 per barrel, a decrease of 44 per cent compared to the second quarter of 2014. ARC's crude oil price is primarily referenced to the Edmonton Par benchmark price, which averaged $67.73 per barrel in the second quarter of 2015, a decrease of 36 per cent compared to the same period in 2014. The differential between WTI and Edmonton Par narrowed to an average discount of US$2.87 per barrel, a 53 per cent decrease compared to the second quarter of 2014. The tightening of the WTI/Edmonton Par differential reflects regional disruptions due to forest fires across Alberta and major plant turnarounds, which resulted in reduced supply and thereby increased competition for available crude oil barrels.

Subsequent to June 30, global crude oil prices declined with the WTI crude oil price dropping approximately 20 per cent from the average of the second quarter. Increasing OPEC production and the potential removal of sanctions on Iran, combined with weaker expectations for global demand growth, have heightened concerns of longer-term supply/demand imbalances, causing the outlook for global crude oil prices to remain bearish through the second half of 2015. The relative weakness in the Canadian dollar compared to the US dollar and a slight narrowing of the WTI/Edmonton Par differential should serve to slightly offset the impact of lower crude oil prices.

North American natural gas prices continued to weaken during the second quarter of 2015. NYMEX Henry Hub ("NYMEX") averaged US$2.64 per MMbtu in the second quarter of 2015, a decrease of 43 per cent compared to the second quarter of 2014. ARC's realized natural gas price is primarily referenced to the AECO hub, which averaged $2.67 per Mcf in the second quarter of 2015, a decrease of 43 per cent compared to the second quarter of 2014. Despite the expectation for US power demand to remain at relatively strong levels and Mexican exports to increase, storage levels in both Canada and the US are expected to be tracking near capacity by the end of the injection season as a result of sustained record US natural gas production levels, which has resulted in a second quarter decrease in both Henry Hub NYMEX and AECO hub benchmark pricing. This signals continued weakness in the natural gas markets through the latter part of 2015.

FINANCIAL REVIEW

Funds from Operations

ARC's second quarter and first half 2015 funds from operations of $206.3 million ($0.61 per share) and $397.8 million ($1.18 per share) were down 30 per cent and 32 per cent, respectively, relative to comparable levels in 2014. While first half 2015 production increased relative to 2014, significantly lower 2015 crude oil and natural gas prices more than offset the gains realized from higher production in the period. The impact of lower commodity prices was partially offset by realized gains on ARC's commodity hedge program in the first half of 2015. Lower royalties and current income taxes, attributed to significantly lower commodity prices, and lower operating costs partially offset the impact of lower average commodity prices in 2015.

The following table details the change in funds from operations for 2015 relative to 2014.

|

Three Months Ended |

Six Months Ended |

||||||||

|

June 30 |

June 30 |

||||||||

|

$ millions |

$/Share (2) |

$ millions |

$/Share (2) |

||||||

|

Funds from operations – 2014 (1) |

295.8 |

0.93 |

588.1 |

1.86 |

|||||

|

Volume variance |

|||||||||

|

Crude oil and liquids |

(44.5) |

(0.13) |

(46.5) |

(0.14) |

|||||

|

Natural gas |

13.1 |

0.04 |

56.6 |

0.17 |

|||||

|

Price variance |

|||||||||

|

Crude oil and liquids |

(132.0) |

(0.39) |

(314.8) |

(0.95) |

|||||

|

Natural gas |

(81.9) |

(0.24) |

(185.4) |

(0.57) |

|||||

|

Realized gain or loss on risk management contracts |

76.2 |

0.22 |

141.0 |

0.42 |

|||||

|

Royalties |

55.4 |

0.16 |

105.0 |

0.31 |

|||||

|

Expenses |

|||||||||

|

Transportation |

(3.0) |

(0.01) |

(10.5) |

(0.03) |

|||||

|

Operating |

10.8 |

0.03 |

17.8 |

0.05 |

|||||

|

General and administrative ("G&A") |

(4.0) |

(0.01) |

5.4 |

0.02 |

|||||

|

Interest |

(0.9) |

— |

(1.8) |

(0.01) |

|||||

|

Current tax |

21.5 |

0.06 |

42.9 |

0.13 |

|||||

|

Realized gain or loss on foreign exchange |

(0.2) |

— |

— |

— |

|||||

|

Diluted shares |

— |

(0.05) |

— |

(0.08) |

|||||

|

Funds from operations – 2015 (1) |

206.3 |

0.61 |

397.8 |

1.18 |

|||||

|

(1) |

Additional GAAP measure which may not be comparable to similar additional GAAP measures used by other entities. Refer to the section entitled "Additional GAAP Measures" contained in the MD&A for the three and six months ended June 30, 2015 and 2014. Also refer to the "Funds from Operations" section in the MD&A for the three and six months ended June 30, 2015 and 2014 for a reconciliation of ARC's net income to funds from operations and cash flow from operating activities. |

|

(2) |

Per share amounts are based on weighted average diluted shares. |

Net Income (Loss)

ARC recorded a net loss of $51 million ($0.15 per share) in the second quarter of 2015 compared to net income of $147.4 million in the second quarter of 2014. In addition to the factors decreasing funds from operations in the second quarter of 2015, ARC recorded non-cash intangible E&E expenses of $44.4 million related to the impairment of one of its E&E assets during the quarter and recognized increased deferred taxes due in part to the increase in the Alberta corporate tax rate that was substantively enacted during the period. Partially offsetting these items was a $10.6 million non-cash gain recorded on the disposal of certain non-core petroleum and natural gas properties during the period.

Operating Netbacks

ARC's second quarter and first half 2015 operating netbacks, before hedging, of $19.29 per boe and $17.52 per boe, were 48 per cent and 54 per cent lower than comparable periods in 2014, respectively. The decrease was due to significantly lower crude oil and natural gas prices. After hedging, ARC's second quarter and first half 2015 netbacks were $24.37 per boe and $22.10 per boe, respectively, 30 per cent and 38 per cent lower than comparable periods in 2014.

ARC's second quarter 2015 total corporate royalty rate of 7.8 per cent ($2.50 per boe) was down from 14.2 per cent ($8.02 per boe) in the second quarter of 2014, while ARC's first half 2015 total corporate royalty rate of 8.8 per cent ($2.66 per boe) decreased from 14.3 per cent ($8.21 per boe) in the first half of 2014. The decrease reflects the sliding scale effect of decreased commodity prices on royalty rates.

Second quarter and first half 2015 transportation costs of $2.33 per boe and $2.35 per boe, respectively, were up 15 per cent and 19 per cent from comparable periods in 2014. Higher transportation costs were primarily due to transportation arrangements for production volumes from the Parkland and Tower areas. Additionally, in the second quarter as a result of maintenance and turnaround activity at a certain third-party facility, ARC was required to secure supplementary takeaway capacity to avoid the possible shut-in of production.

Second quarter and first half 2015 operating expenses of $8.05 per boe and $7.63 per boe, respectively, were 12 per cent and 16 per cent lower than comparable periods in 2014. Lower per boe operating expenses were attributed to certain realized cost savings and the addition of new production at lower relative costs to operate.

Risk Management

ARC has hedge contracts in place to protect prices on a portion of crude oil volumes for 2015 through 2017 and natural gas volumes for the period 2015 through 2019 at prices that support ARC's business plan.

During the second quarter and first half of 2015, ARC realized cash gains of $17.6 million and $35.3 million on crude oil hedging contracts, respectively. ARC currently has 15,000 barrels per day of crude oil production hedged for the second half of 2015. Additional crude oil production is hedged for the period 2016 through 2017. Details regarding ARC's crude oil hedged volumes and prices for the period 2015 through 2017 are outlined in the table below.

During the second quarter and first half of 2015, ARC realized cash gains of $34 million and $63.4 million on natural gas hedging contracts, respectively, as approximately 50 per cent of natural gas production was hedged at an average floor price of approximately US$3.94 per MMbtu, while market prices averaged US$2.81 per MMbtu. ARC has hedged approximately 215,000 MMbtu per day of natural gas production for the remainder of 2015 and a portion of natural gas production is hedged for the period 2016 through 2019. ARC's natural gas hedging portfolio includes AECO basis swap contracts which fix the AECO price received to approximately 86 to 90 per cent of the Henry Hub NYMEX price on a portion of its natural gas volumes for 2015 through 2019. ARC's natural gas hedges support long-term development economics for ARC's significant natural gas resource base. Details regarding ARC's natural gas hedged volumes and prices for the period 2015 through 2019 are outlined in the table below.

ARC will continue to take positions in natural gas, crude oil, foreign exchange rates, power and interest rates, as appropriate, to provide greater certainty over future cash flows. For a complete listing and terms of ARC's hedging contracts, see Note 8 "Financial Instruments and Market Risk Management" in the unaudited Condensed Interim Consolidated Financial Statements for the three and six months ended June 30, 2015 and 2014.

|

Hedge Positions Summary (1) |

|||||||||||||||||||||

|

As at July 29, 2015 |

H2 2015 |

2016 |

2017 |

2018 |

2019 |

||||||||||||||||

|

Crude Oil - Cdn$ WTI (2) |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

|||||||||||

|

Ceiling |

80.95 |

10,000 |

83.38 |

3,000 |

83.38 |

1,488 |

— |

— |

— |

— |

|||||||||||

|

Floor |

61.45 |

10,000 |

70.00 |

3,000 |

70.00 |

1,488 |

— |

— |

— |

— |

|||||||||||

|

Crude Oil - Cdn$ WTI (2) |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

Cdn$/bbl |

bbl/day |

|||||||||||

|

Swap |

74.77 |

5,000 |

77.20 |

7,000 |

— |

— |

— |

— |

— |

— |

|||||||||||

|

Crude Oil - MSW (Differential to WTI) (3) |

US$/bbl |

bbl/day |

US$/bbl |

bbl/day |

US$/bbl |

bbl/day |

US$/bbl |

bbl/day |

US$/bbl |

bbl/day |

|||||||||||

|

Swap |

(4.32) |

3,750 |

— |

— |

— |

— |

— |

— |

— |

— |

|||||||||||

|

Natural Gas - NYMEX (4) |

US$/MMbtu |

MMbtu/day |

US$/MMbtu |

MMbtu/day |

US$/MMbtu |

MMbtu/day |

US$/MMbtu |

MMbtu/day |

US$/MMbtu |

MMbtu/day |

|||||||||||

|

Ceiling |

4.51 |

215,000 |

4.79 |

105,000 |

4.81 |

145,000 |

4.92 |

90,000 |

5.00 |

40,000 |

|||||||||||

|

Floor |

3.94 |

215,000 |

4.00 |

105,000 |

4.00 |

145,000 |

4.00 |

90,000 |

4.00 |

40,000 |

|||||||||||

|

Swap |

— |

— |

4.00 |

40,000 |

— |

— |

— |

— |

— |

— |

|||||||||||

|

Natural Gas - AECO (5) |

Cdn$/GJ |

GJ/day |

Cdn$/GJ |

GJ/day |

Cdn$/GJ |

GJ/day |

Cdn$/GJ |

GJ/day |

Cdn$/GJ |

GJ/day |

|||||||||||

|

Swap |

— |

— |

3.00 |

20,000 |

— |

— |

— |

— |

— |

— |

|||||||||||

|

Natural Gas - AECO Basis (6) |

AECO/NYMEX |

MMbtu/day |

AECO/NYMEX |

MMbtu/day |

AECO/NYMEX |

MMbtu/day |

AECO/NYMEX |

MMbtu/day |

AECO/NYMEX |

MMbtu/day |

|||||||||||

|

Swap (percentage of NYMEX) |

89.5 |

160,000 |

90.3 |

140,000 |

90.2 |

140,000 |

85.7 |

80,000 |

85.6 |

24,918 |

|||||||||||

|

Foreign Exchange |

Cdn$/US$ |

US$ Millions Total |

Cdn$/US$ |

US$ Millions Total |

Cdn$/US$ |

US$ Millions Total |

Cdn$/US$ |

US$ Millions Total |

Cdn$/US$ |

US$ Millions Total |

|||||||||||

|

Ceiling |

1.0725 |

24 |

— |

— |

— |

— |

— |

— |

— |

— |

|||||||||||

|

Floor |

1.0463 |

24 |

— |

— |

— |

— |

— |

— |

— |

— |

|||||||||||

|

(1) |

The prices and volumes in this table represent averages for several contracts representing different periods. The average price for the portfolio of options listed above does not have the same payoff profile as the individual option contracts. Viewing the average price of a group of options is purely for indicative purposes. All positions are financially settled against the benchmark prices disclosed in Note 8 "Financial Instruments and Market Risk Management" in the financial statements for the three and six months ended June 30, 2015. |

|

(2) |

Crude oil prices referenced to WTI, multiplied by the Bank of Canada monthly average noon day rate. |

|

(3) |

MSW differential refers to the discount between WTI and the mixed sweet crude grade at Edmonton, calculated on a monthly weighted average basis in US$. |

|

(4) |

Natural gas prices referenced to NYMEX Henry Hub. |

|

(5) |

Natural gas prices referenced to AECO 7(a) index. |

|

(6) |

ARC sells the majority of its natural gas production based on AECO pricing. To reduce the risk of weak basis pricing (AECO relative to NYMEX Henry Hub), ARC has hedged a portion of production by tying ARC's price to a percentage of the NYMEX Henry Hub natural gas price. |

OPERATIONAL REVIEW

ARC's capital expenditures totalled $98.4 million, before land and net acquisitions and dispositions, during the second quarter. The majority of second quarter activity was focused on the British Columbia Montney region with the drilling of 12 gross operated wells (five oil wells and seven natural gas wells) and construction continuing on key infrastructure projects at Sunrise and Tower. During the first quarter of 2015 certain completions activities were deferred pending the improvement in economic conditions and realized cost savings. ARC resumed completions activities at Dawson, Parkland and Sunrise in the second quarter and plans to resume completions at Ante Creek in the third quarter. ARC completed numerous turnarounds during the second quarter to coincide with the timing of planned third-party turnarounds in the same period as a means to limit overall downtime.

ARC achieved second quarter production of 109,900 boe per day, which was at the high end of the second quarter volume guidance range of 107,000 to 110,000 boe per day. ARC's second quarter natural gas production was 426 MMcf per day (65 per cent of total production) and second quarter crude oil and liquids production was 38,892 barrels per day (35 per cent of total production). Second quarter total production decreased slightly relative to the second quarter of 2014, and was nine per cent lower than the first quarter of 2015. Lower second quarter 2015 production was mainly due to planned third-party maintenance and turnaround activity, reduced capital spending and the divestment of approximately 2,400 boe per day of non-core shallow gas assets early in the second quarter. Optimization activities during the second quarter supported production levels, partially offsetting losses from maintenance and facility-related downtime and contributed to meeting the high end of the guided range. ARC volumes were not impacted by the broad-scale TCPL interruptions during the second quarter as ARC has 100 per cent firm transportation commitments in place.

ARC expects a considerable portion of the $550 million 2015 capital program to be directed to the British Columbia Montney region with estimated total spending of approximately $340 million focused predominantly on drilling at Tower, Sunrise and Dawson to keep facilities full. With service cost reductions and capital efficiency gains contributing to cost savings of approximately 20 per cent, ARC expects to achieve year-over-year production growth despite the significant capital reduction in 2015.

With the considerable reduction to ARC's 2015 capital program, and the sale of 2,400 boe per day of shallow gas production in the second quarter of 2015, ARC expects the 2015 annual average production to be within the range of 113,000 to 116,000 boe per day. ARC expects third quarter production to be in the range of 104,000 to 107,000 boe per day due to downtime attributed to a significant planned turnaround at Dawson. ARC expects a significant increase in fourth quarter 2015 production to a range of 122,000 to 126,000 boe per day following commissioning of the new Sunrise gas processing facility and expanded Tower oil battery.

Capital plans and spending may be revised throughout 2015, as necessary, in response to market conditions.

Parkland/Tower

ARC has a land position of 23 net sections at Parkland, a Montney liquids-rich natural gas play, located in northeast BC. ARC's Tower property consists of 57 net sections of contiguous land north and west of the Parkland field, producing predominantly light oil and free condensate with additional liquids in the gas stream; therefore providing favorable economics.

During the first half of 2015, ARC spent approximately $44 million on capital activities at Parkland/Tower. ARC drilled two gross operated liquids-rich natural gas wells at Parkland and 11 gross operated oil wells at Tower. Parkland/Tower second quarter 2015 production averaged 22,240 boe per day (23 per cent crude oil and liquids and 77 per cent natural gas), an eight per cent increase from the second quarter of 2014, due to new production brought on-stream to fill the new facilities through the course of 2014 and continued strong results from Tower wells drilled in 2014. Second quarter 2015 Parkland/Tower production was down nine per cent relative to the first quarter of 2015 due to downtime attributed to maintenance at certain third-party facilities.

Well performance at Tower continues to be exceptional. Seven of the eight wells on the 8-15 pad have now exceeded 100,000 barrels of cumulative oil production in less than a year on production. In the first quarter of 2015, ARC drilled eight wells on the 8-24 pad and commenced completions of the wells in the third quarter of 2015. Production from the pad is expected to be on production late in the third quarter. The drilling program at Tower has seen significant cost reductions and operational efficiency gains with two active drilling rigs in this area through the second quarter of 2015. Drilling times were down by approximately 25 per cent from the 2014 program, which has translated into drill cost savings of approximately 20 per cent.

Through the first quarter of 2015, all NGLs production from Parkland and a significant portion of oil production at Tower was transported by truck due to limited pipeline infrastructure. Early in the second quarter of 2015, with the completion of certain third-party pipeline expansion projects, ARC commenced the flow of 100 per cent of oil production at Parkland/Tower via pipeline. ARC expects that 100 per cent of NGLs production at Parkland/Tower will be tied-in and transported via pipeline in the second half of 2015. With this change, ARC has experienced a reduction in per boe transportation costs and expects a further reduction once all production is pipeline-connected.

ARC expects to spend approximately $170 million at Parkland/Tower in 2015 to drill a total of 24 gross operated wells (22 oil wells at Tower and two liquids-rich natural gas wells at Parkland). Given the strong results to-date at Tower, a considerable portion of the 2015 drilling program is being directed to Tower. At Parkland, ARC does not currently anticipate any additional wells to be drilled in 2015, however, completions which were deferred in the first quarter are scheduled to commence in the third quarter of 2015, with production coming on late in the third quarter. ARC expects 2015 annual production at Parkland/Tower to average approximately 24,000 boe per day, approximately 10 per cent higher than average 2014 production. Parkland/Tower production is expected to increase in the fourth quarter as incremental crude oil and liquids production is brought on-stream through the expanded Tower liquids-handling facility, increasing liquids-handling capacity from 5,000 barrels per day to 10,000 barrels per day.

Sunrise

At Sunrise, a natural gas Montney play in northeast BC, ARC has a land position of 32 net sections. The Sunrise property has a significant natural gas resource base, high well deliverability, and low capital and operating costs; thereby providing high rates of return even at relatively low natural gas prices. Currently at Sunrise, ARC is producing from four layers of the Montney. Second quarter 2015 Sunrise production was approximately 63 MMcf per day of natural gas production, up 80 per cent relative to the second quarter of 2014, due to new wells brought on-stream over this period and increased capacity at a third-party gas plant. Sunrise production was down 12 per cent relative to the first quarter of 2015 as a result of downtime at the third-party facility.

During the first half of 2015, ARC spent $96 million on capital activities at Sunrise to drill nine gross operated horizontal natural gas wells and continue with the construction of an ARC-operated 60 MMcf per day gas processing facility. The new facility is mechanically complete and TCPL began construction of the sales meter station late in the second quarter of 2015. Commissioning is expected to begin prior to the end of August 2015, however, actual timing will depend on the completion and tie-in of the sales meter station.

Sunrise continues to provide robust economics even at low gas prices and is expected to be a source of long-term value creation. In the second half of 2015, ARC plans to spend an additional $35 million for development drilling and infrastructure spending to complete and commission the new 60 MMcf per day Sunrise gas processing facility. ARC has drilled nine gross operated natural gas wells at Sunrise in the first half of 2015 in preparation for the on-stream date of the new facility, and plans to drill a total of 13 gross operated natural gas wells at Sunrise in 2015. ARC expects Sunrise production to average 83 MMcf per day in 2015; a greater than 100 per cent year-over-year increase in production relative to 2014. Sunrise production will increase to greater than 120 MMcf per day once the new ARC-operated facility is full. ARC expects a substantial portion of the new facility capacity to be filled shortly within the on-stream date, with the remaining capacity to be filled by early 2016.

Dawson

The Dawson Montney play is the foundation of ARC's profitable low cost natural gas business. Dawson production averaged 159 MMcf per day of natural gas and 820 barrels per day of condensate and liquids during the second quarter of 2015. Second quarter 2015 production was relatively flat compared to the second quarter of 2014 and was down five per cent compared to the first quarter of 2015, due to a planned turnaround at the ARC 1-34 compressor station. Dawson continues to perform well, delivering robust economics and significant cash flow at current natural gas prices due to exceptional well results, excellent capital efficiencies and low operating costs.

ARC spent approximately $17 million on capital activities at Dawson during the first half of 2015 and drilled four gross operated natural gas wells. During the fourth quarter of 2014, ARC drilled and completed two liquids-rich natural gas wells into the Lower Montney to assess the potential for higher liquids content; one of the lower Montney wells was brought on production during the first quarter of 2015 and the second lower Montney well is expected to be brought on production in third quarter of 2015. Results from the first lower Montney well are encouraging with the well currently producing approximately 2 MMcf per day of natural gas and over 40 barrels per MMcf of free condensate. In addition, ARC expects the NGLs recovery for the lower Montney well to be approximately 35 barrels per MMcf.

ARC plans to maintain production at current facility capacity levels through 2015 and into 2016. During 2015, ARC plans to spend approximately $45 million at Dawson to drill nine gross operated natural gas and liquids-rich natural gas wells. During 2015, ARC expects production to be relatively flat at facility capacity levels, with the exception of lower production in the third quarter of 2015 due to a scheduled turnaround on the 120 MMcf per day Dawson facility, which is expected to last approximately two weeks.

Given the significant drilling inventory at Dawson and the potential for higher liquids production, ARC plans to proceed with a new 90 MMcf per day gas processing and liquids-handling facility at Dawson, which is currently planned to be on-stream in 2017. The new facility will have gas sales capacity of 90 MMcf per day and approximately 7,500 barrels per day of liquids-handling capacity (approximately 50 per cent condensate). ARC submitted an application for the new facility during the first quarter of 2015 and expects the regulatory review/approval process to take approximately six to eight months. The timing of the start-up of the new Dawson facility is dependent upon receiving all required regulatory approvals, efficient construction of the facility, and approval of a 2016 capital budget that provides appropriate funding.

Attachie

ARC's Attachie property is a highly prospective, Montney oil and liquids-rich natural gas play located in northeast BC. In the second quarter of 2015, ARC acquired an additional 89 net Montney sections located directly north of ARC's existing Attachie lands. The acquisition brings ARC's total land position in Attachie to 279 net Montney sections.

ARC has had two wells on production at West Attachie for over a year. Given the promising results from these wells, as well as successful industry wells offsetting the newly acquired northern lands, ARC sees significant opportunity in the area and plans to drill three wells on the newly acquired lands in the second half of 2015. Completion of these wells and evaluation of results is expected to take place in 2015 and 2016. In the western portion of Attachie, ARC has plans to drill two new wells in the winter of 2015/2016 which will be tied into the existing West Attachie Pilot.

Click the link to view a map showing ARC's Attachie land base: http://files.newswire.ca/894/Attachie_Map.jpg

Ante Creek

ARC has a land position of 340 net sections at Ante Creek, a Montney oil play in northern Alberta with significant future growth potential. Second quarter 2015 Ante Creek production averaged 16,640 boe per day (approximately 50 per cent crude oil and liquids) down seven per cent relative to the second quarter of 2014 and down three per cent compared to the first quarter of 2015. Lower production was the result of reduced activity levels starting in late 2014 and the deferral of well completions, which resulted in limited new production coming on-stream.

During the first half of 2015, ARC spent $34 million on capital activities at Ante Creek. ARC drilled five gross operated oil wells during the first quarter of 2015, deferring completions to future periods. ARC plans to resume completions activities in the third quarter of 2015, with associated volumes coming on-stream late in the quarter. ARC plans to spend approximately $28 million at Ante Creek during the remainder of 2015 to complete existing wells and focus on maintenance and optimization activities. Given the reduced capital investment at Ante Creek, ARC expects 2015 Ante Creek production to average approximately 16,500 boe per day. ARC plans to continue to delineate this large, prospective land base and to assess infrastructure requirements in conjunction with future development plans for Ante Creek.

Pembina

ARC's Pembina Cardium assets continue to provide stable, high netback light oil production. Pembina production averaged approximately 10,900 boe per day (80 per cent light oil and liquids) in the second quarter of 2015, three per cent lower than the second quarter of 2014, and 10 per cent lower than the first quarter of 2015. Lower second quarter production was due to planned maintenance and turnarounds, as well as reduced activity levels starting in late 2014, which include the deferral of drilling and well completions and resulted in limited new production coming on-stream.

Through the first half of the year, ARC spent $9 million on capital activities at Pembina and drilled a total of four gross operated Cardium horizontal wells. No drilling took place in the second quarter of 2015. ARC deferred the completions for all wells drilled in the first quarter of 2015 to future periods pending the improvement in economic conditions and realization of additional cost savings. ARC plans to complete existing wells and focus on maintenance and optimization activities through the remainder of 2015. Given the limited capital investment at Pembina in 2015 and deferral of certain capital projects, ARC expects Pembina production to decrease slightly over the course of 2015 to average approximately 11,000 boe per day.

Southeast Saskatchewan and Manitoba

ARC's Southeast Saskatchewan and Manitoba region contributes high quality crude oil. Second quarter 2015 production averaged approximately 10,100 boe per day of light oil, down seven per cent from the second quarter of 2014, and down seven per cent from the first quarter of 2015. Lower second quarter production was due to reduced activity levels starting in late 2014 including the deferral of drilling and well completions, which resulted in limited new production coming on-stream.

ARC spent approximately $14 million on development and optimization activities on operated and non-operated properties in this region in the first half of 2015, including the drilling of two gross operated oil wells in the first quarter of the year. With limited capital investment in 2015 and deferral of certain capital projects, ARC expects production in this region to decrease over the course of 2015 to average approximately 9,700 boe per day.

DIVIDENDS

ARC paid dividends totaling $0.30 per share for the second quarter of 2015. The Board of Directors has confirmed a dividend of $0.10 per share for July 2015, payable on August 17, 2015, and has conditionally declared a monthly dividend of $0.10 per share for August 2015 through October 2015 payable as follows:

|

Ex-dividend date |

Record date |

Payment date |

Per share amount |

|

July 29, 2015 |

July 31, 2015 |

August 17, 2015 |

$0.10 (1) |

|

August 27, 2015 |

August 31, 2015 |

September 15, 2015 |

$0.10 (2) |

|

September 28, 2015 |

September 30, 2015 |

October 15, 2015 |

$0.10 (2) |

|

October 28, 2015 |

October 30, 2015 |

November 16, 2015 |

$0.10 (2) |

|

(1) |

Confirmed on July 16, 2015. |

|

(2) |

Conditionally declared, subject to confirmation by news release and further resolution by the Board of Directors. |

ARC's shareholders may receive dividend payments in the form of cash or may elect to receive dividend payments in the form of common shares through the company's Stock Dividend Program ("SDP"). Shareholders may reinvest cash dividends into additional common shares of ARC through the Dividend Reinvestment Plan ("DRIP"). Participation in the SDP or DRIP is optional. Shareholders will continue to receive dividend payments in cash unless they choose to participate in the SDP or DRIP. Shareholders, wherever resident, are encouraged to consult their own tax advisors regarding the tax consequences to them of receiving cash or stock dividends or participating in the DRIP.

During the second quarter of 2015, ARC declared dividends of $102.1 million, of which $11.3 million was issued in the form of common shares under the SDP and $37 million was reinvested into ARC shares through the DRIP. The DRIP and SDP are a source of funding for ARC's capital program.

For additional details regarding the SDP and DRIP including terms, eligibility, and enrollment procedures, please see our website at www.arcresources.com.

The dividends have been designated as eligible dividends under the Income Tax Act (Canada). The declaration of the dividends is conditional upon confirmation by news release and is subject to any further resolution of the Board of Directors. Dividends are subject to change in accordance with ARC's dividend policy depending on a variety of factors and conditions existing from time-to-time, including fluctuations in commodity prices, production levels, capital expenditure requirements, debt service requirements, operating expenses, royalty burdens, foreign exchange rates and the satisfaction of solvency tests imposed by the Business Corporations Act (Alberta) for the declaration and payment of dividends.

OUTLOOK

The foundation of ARC's business strategy is "risk-managed value creation." High quality assets, operational excellence, financial strength, and top talent are the key principles underpinning ARC's business strategy. ARC's goal is to create shareholder value in the form of regular dividends and anticipated capital appreciation relating to future profitable growth.

In response to the deterioration in crude oil prices, on April 29, 2015, ARC announced a reduced 2015 capital budget of $550 million (see news release entitled "ARC Resources Ltd. Reports Record First Quarter Production"). The reduction represents a 37 per cent decrease from the original 2015 capital program of $875 million. While we continue to see significant long-term value throughout our entire asset base, capital spending will primarily be focused on the British Columbia region for the remainder of 2015 in order to maximize value during the current period of low commodity prices. The 2015 capital budget includes spending on strategic long-term development and infrastructure projects at Sunrise and Tower, which create additional productive capacity and set the stage for long-term profitable growth. ARC's 2015 capital program is dynamic and capital will be allocated to the highest rate-of-return projects in response to market conditions during 2015.

The reduced 2015 capital program, together with net proceeds from the January 2015 equity offering, will preserve ARC's strong financial position and provide financial flexibility to execute capital programs through the current commodity price environment. Ongoing commodity price volatility may affect ARC's funds from operations and rates of return on capital programs. As crude oil prices have declined subsequent to the end of the second quarter, and further volatility in commodity prices is expected, ARC will continue to take steps to mitigate these risks, focus on capital discipline and protect its strong financial position.

ARC's full-year average production guidance is expected to be in the range of 113,000 to 116,000 boe per day. Full-year average production guidance includes the impact of, reduced capital spending; the sale of 2,400 boe per day of shallow gas properties in the second quarter of 2015; reduced production volumes in the second and third quarters of 2015 due to turnaround and maintenance activities; and increased fourth quarter 2015 production upon commissioning of the new Sunrise gas plant and expanded Tower oil battery.

|

2015 Guidance (1)(2) |

2015 YTD |

% Variance | |||

|

Production |

|||||

|

Oil (bbl/d) |

33,500 - 34,500 |

33,894 |

— | ||

|

Condensate (bbl/d) |

3,400 - 3,800 |

3,363 |

(1) | ||

|

Gas (MMcf/d) |

430 - 440 |

442.7 |

1 | ||

|

NGLs (bbl/d) |

4,500 - 4,900 |

4,053 |

(10) | ||

|

Total (boe/d) |

113,000 - 116,000 |

115,098 |

— | ||

|

Expenses ($/boe) |

|||||

|

Operating |

8.20 - 8.50 |

7.63 |

(7) | ||

|

Transportation |

2.00 - 2.20 |

2.35 |

7 | ||

|

G&A (3) |

2.00 - 2.30 |

1.63 |

(19) | ||

|

Interest |

1.10 - 1.30 |

1.20 |

— | ||

|

Current income tax (per cent of Funds from Operations) (4) |

0 - 5 |

1 |

— | ||

|

Capital expenditures before land purchases and net property dispositions ($ millions) |

550 |

227.9 |

N/A | ||

|

Land purchases and net property dispositions ($ millions) |

— |

(10.3) |

N/A | ||

|

Weighted average shares, diluted (millions) |

339 |

337 |

N/A | ||

|

(1) |

Incorporates impact of divested non-core shallow gas assets located in southern Alberta with associated production of approximately 2,400 boe per day. This transaction closed in the second quarter of 2015. |

|

|

(2) |

ARC expects third quarter 2015 production to decrease to a range of 104,000 to 107,000 boe per day due to downtime attributed to a significant planned turnaround at Dawson. ARC expects a significant increase in fourth quarter 2015 production to a range of 122,000 to 126,000 boe per day following commissioning of the new Sunrise gas processing facility and expanded Tower oil battery. |

|

|

(3) |

G&A expenses per boe are based on a range of $1.65 - $1.70 per boe prior to the recognition of any expense associated with ARC's long-term incentive plans and $0.35 - $0.60 per boe associated with ARC's long-term incentive plans. Actual per boe costs for each of these components for the six months ended June 30, 2015 were $1.64 and a recovery of $0.01 per boe, respectively. |

|

|

(4) |

The 2015 corporate tax estimate will vary depending on level of commodity prices. |

|

ARC's 2015 guidance is based on full-year 2015 estimates; certain variances between first half 2015 actual results and 2015 full-year guidance estimates were due to the cyclical nature of operations. ARC expects full-year 2015 actual results to closely approximate guidance as the year progresses. On a per boe basis, first half 2015 operating expenses were below the 2015 guidance range due to the deferral of certain discretionary spending and general costs savings; ARC expects full-year 2015 actual operating expenses to closely approximate guidance as the year progresses. First half transportation expenses exceeded the full-year guidance estimates as ARC incurred additional trucking costs during the first quarter and saw an increase in pipeline tariff costs as more production became pipeline-connected in the second quarter; ARC expects full-year 2015 actual transportation expenses to closely approximate guidance as the year progresses. First half G&A expenses were below guidance due to reduced costs associated with ARC's long-term incentive plans due to the reduction in ARC's share price at June 30, 2015; ARC expects full-year 2015 actual G&A expenses to closely approximate guidance as the year progresses.

Forward-looking Information and Statements

This news release contains certain forward-looking information and statements within the meaning of applicable securities laws. The use of any of the words "expect," "anticipate," "continue," "estimate," "objective," "ongoing," "may," "will," "project," "should," "believe," "plans," "intends," "strategy" and similar expressions are intended to identify forward-looking information or statements. In particular, but without limiting the foregoing, this news release contains forward-looking information and statements pertaining to the following: guidance as to the capital expenditure plans of ARC and its future production under the heading "Financial and Operational Highlights," as to its views on the effect of commodity prices under the heading "Economic Environment," as to its risk management plans for 2015 and beyond under the heading "Risk Management," as to its production, exploration and development plans for 2015 and beyond under the heading "Operational Review," and all matters including 2015 guidance under the heading "Outlook."

The forward-looking information and statements contained in this news release reflect material factors and expectations and assumptions of ARC including, without limitation: that ARC will continue to conduct its operations in a manner consistent with past operations; the general continuance of current industry conditions; the continuance of existing (and in certain circumstances, the implementation of proposed) tax, royalty and regulatory regimes; the accuracy of the estimates of ARC's reserves and resource volumes; certain commodity price and other cost assumptions; and the continued availability of adequate debt and equity financing and funds from operations to fund its planned expenditures. ARC believes the material factors, expectations and assumptions reflected in the forward-looking information and statements are reasonable but no assurance can be given that these factors, expectations and assumptions will prove to be correct.

The forward-looking information and statements included in this news release are not guarantees of future performance and should not be unduly relied upon. Such information and statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information or statements including, without limitation: changes in commodity prices; changes in the demand for or supply of ARC's products; unanticipated operating results or production declines; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in development plans of ARC or by third-party operators of ARC's properties, increased debt levels or debt service requirements; inaccurate estimation of ARC's oil and gas reserve and resource volumes; limited, unfavorable or a lack of access to capital markets; increased costs; a lack of adequate insurance coverage; the impact of competitors; and certain other risks detailed from time to time in ARC's public disclosure documents (including, without limitation, those risks identified in this news release and in ARC's Annual Information Form).

The forward-looking information and statements contained in this news release speak only as of the date of this news release, and none of ARC or its subsidiaries assumes any obligation to publicly update or revise them to reflect new events or circumstances, except as may be required pursuant to applicable laws.

ARC Resources Ltd. ("ARC") is one of Canada's largest conventional oil and gas companies with an enterprise value of approximately $7.4 billion. ARC's Common Shares trade on the TSX under the symbol ARX.

ARC RESOURCES LTD.

Myron M. Stadnyk

President and Chief Executive Officer

SOURCE ARC Resources Ltd.

Image with caption: "In the second quarter of 2015, ARC acquired an additional 89 net Montney sections located directly north of ARC's existing Attachie lands. The acquisition brings ARC's total land position in Attachie to 279 net Montney sections. (CNW Group/ARC Resources Ltd.)". Image available at: http://photos.newswire.ca/images/download/20150729_C6740_PHOTO_EN_462266.jpg

For further information: For further information about ARC Resources Ltd., please visit our website www.arcresources.com or contact: Investor Relations, E-mail: ir@arcresources.com, Telephone: (403) 503-8600, Fax: (403) 509-6427, Toll Free 1-888-272-4900; ARC Resources Ltd., Suite 1200, 308 - 4th Avenue S.W., Calgary, AB T2P 0H7